Archive for Uncategorized

Toyota to Invest Record $1.3B in Kentucky Plant

Posted by: | Comments

Toyota announced its 7.5 million-square-foot Georgetown, Ky., plant—the automaker’s largest factory in the world—will get a record $1.33 billion in improvements and local commercial real estate brokers say that helps boost the region’s overall industrial market.

“The Toyota investment is great news for all of Central Kentucky and Georgetown, Ky., in particular. This market condition creates immediate opportunities for new development of industrial parks and speculative construction of industrial facilities. The Toyota investment will serve to bolster an industrial market that is already doing very well,” Al Isaac, president of NAI Isaac in Lexington, Ky., told Commercial Property Executive…

Daewoo Shipbuilding’s Bailout Plan Cleared by Pension Fund

Posted by: | Comments-

National Pension Service held key to Daewoo Ship’s survival

-

Bond holders are scheduled to meet Monday, Tuesday in Seoul

South Korea’s National Pension Service agreed to restructure 1.55 trillion won ($1.4 billion) of bonds issued by Daewoo Shipbuilding & Marine Engineering Co., helping the world’s largest shipbuilder tide over a payment crisis that had threatened to almost shut the company.

An agreement came after Daewoo, the Korea Development Bank and Export-Import Bank of Korea took steps to ensure repayment of the debts, the pension service said in a statement April 16. Banks agreed to convert 80 percent of loans to Daewoo into shares and to extend maturity of the remainder, the Financial Services Commission said separately…

Boston’s Center Plaza Commands $365M

Posted by: | CommentsCenter Plaza, a 741,200-square-foot mixed-use property with a distinctive curved shape located across from Boston City Hall, is under new ownership. Synergy Investments and GreenOak Real Estate acquired the asset from Shorenstein Properties LLC for $365 million.

Shorenstein paid $307 million when it bought Center Plaza from Equity Office Properties Trust on Dec. 31, 2013. Since 1992, Shorenstein has sponsored 11 closed-end investment funds with total equity commitments of $7.9 billion. It acquired Center Plaza on behalf of its 10th fund, Shorenstein Realty Investors Ten LP, formed in 2010 with $1.2 billion of committed capital, according to a Commercial Property Executive report…

Ant Financial Raises MoneyGram Bid 36% to Fend Off Euronet

Posted by: | Comments-

Cash offer values all the shares of MoneyGram at $1.2 billiuon

-

Revised $18 a share deal has unanimous backing of board

Ant Financial raised its agreed offer for MoneyGram International Inc. by 36 percent as the financial-services company controlled by Chinese billionaire Jack Ma tries to top a competing offer.

The revised bid is worth $18 a share in cash, up from a previous offer of $13.25, the companies said in a joint statement. The new deal, which has the backing of MoneyGram’s board, values all the common and preferred stock at $1.2 billion, it said. Euronet Worldwide Inc. last month offered $15.20 a share for the Dallas-based payments company…

Office Condo Tower Tops Off in Coral Gables

Posted by: | Comments

Co-developers TSG and BF Group recently completed the topping off of a 97,669-square-foot, 16-story mixed-use condo tower in Coral Gables, Fla. Ofizzina, already 80 percent sold, will offer 54 offices, three ground-floor retail spaces, a rooftop terrace and more than 300 parking spots.

Boris Johnson’s Housing Bank Set to Fall 90% Short of Target

Posted by: | Comments-

Just 270 homes out of 3,000 target due for completion in 2018

-

Rental restrictions limiting demand for the finance: analyst

A housing bank set up by former Mayor of London Boris Johnson to speed up the development of 3,000 homes in the U.K. capital by 2018 is set to deliver just 9 percent of its target.

Just 270 homes are due to be completed by March of next year via a single project in the Ealing borough, according to data compiled by the mayor’s office. To date, the bank has loaned 10.5 percent of the 200 million pounds ($250 million) of credit set aside to help construct houses and apartments…

Falling Inflation, Retail Sales Bolster Fed’s Go-Slow Approach

Posted by: | Comments-

Core consumer-price index drops by the most since 1982

-

Sales at retailers fall for second month; car purchases slide

The economic case for a Federal Reserve interest-rate increase in June just became a little less solid.

Inflation took a surprising step back in March at the same time retail sales dropped for a second month, according to a pair of U.S. government reports on Friday. Labor Department data showed the consumer-price index fell a larger-than-forecast 0.3 percent, while a measure excluding food and energy fell by the most since 1982…

Falling Inflation, Retail Sales Bolster Fed’s Go-Slow Approach

Rockefeller Group Finds Manhattan Elbow Room for Deloitte

Posted by: | CommentsDeloitte signed a lease with Rockefeller Group for 98,000 square feet on the 39th and 40th floors of 1221 Avenue of the Americas in Manhattan. The company is expanding from its current headquarters at 30 Rockefeller Plaza…

Henry Hillman, Who Helped Fund KKR, Kleiner Perkins, Dies at 98

Posted by: | Comments-

Pittsburgh billionaire expanded the family’s industrial base

-

He was among the ‘least-known powerful individuals in America’

Henry Hillman, a billionaire who diversified his family’s Pittsburgh-based coal and coke fortune and provided startup funding for private-equity firm KKR & Co. and Silicon Valley venture-capital company Kleiner Perkins Caufield & Byers, has died. He was 98.

He died Friday at Shadyside Hospital in Pittsburgh, Audrey Hillman Fisher, his daughter, said in a statement…

Henry Hillman, Who Helped Fund KKR, Kleiner Perkins, Dies at 98

AC Hotel Miami Aventura Set to Open in May

Posted by: | Comments

AC Hotels by Marriott is expanding its presence in the Miami area, with AC Hotel Miami Aventura set to open in mid-May. Craft Construction Co. is developing the new hotel, which will be just minutes away from the Aventura Mall and Gulfstream Park.

Pyramid Hotel Group will manage the 233-key hotel, adding to the company’s large portfolio of managed properties.

Equity Office Taps Top Financial Website as Tenant

Posted by: | CommentsEquity Office Properties Trust secured a new lease at 114 W. 41st St., one of its prime New York properties. Investopedia, the world’s leading source of online financial content, will occupy the entire eighth floor, which comprises 15,931 square feet. The tenant is expected to finish relocating from its current headquarters at 110 E. 42nd St. by the end of September. Steven Rotter and Dan Santagata of JLL acted on behalf of Investopedia. Zachary Freeman and Scott Silverstein, along with Erik Harris, Scott Klau, Ben Shapiro and Zach Weil of Newmark Grubb Knight Frank, represented the owner.

Shared Office Space Provider Expands in New York City

Posted by: | CommentsAs the shared workspace industry is booming across the U.S., Jay Suites is on track to become one of Big Apple’s largest co-working space providers. The company has announced plans to open its first executive business center in Manhattan, expanding its New York City footprint to more than 250,000 square feet of luxury office suites and co-working space…

Ontario Vows to Cool Housing Market as April 27 Budget Awaited

Posted by: | Comments-

‘Looking at a number of alternatives’ to temper market: Sousa

-

‘Hot’ market making it tough to buy first homes, Sousa says

Ontario Finance Minister Charles Sousa is considering a number of measures to cool the housing market as he prepares to unveil his annual budget on April 27.

Sousa didn’t elaborate on specific steps in a speech at the Empire Club of Canada in Toronto on Thursday, and didn’t say if they’ll be in the budget. He will meet with Canada’s Finance Minister Bill Morneau and Toronto Mayor John Tory on Tuesday to discuss the housing market.

Wells Fargo Falls as Revenue Misses Wall Street’s Estimates

Posted by: | Comments-

CFO cites higher first-quarter ‘personnel-related expenses’

-

Bank collects least mortgage revenue in the past two years

Wells Fargo & Co. fell after reporting first-quarter revenue that missed analysts’ estimates as the lender’s troubled community bank weighed on results.

Wells Fargo shares slid 3 percent to $51.53 at 1:08 p.m. in New York, the lowest since Nov. 29 and the worst performance in the 65-company S&P 500 Financials Index. The stock has dropped 6.4 percent this year.

Affirm Inks New Office Lease Deal in San Francisco

Posted by: | CommentsAffirm, a financial technology company, signed an 86,225-square-foot, eight-year lease at 650 California St. in San Francisco, bringing the occupancy of the building to 89 percent. Expected to relocate its headquarters from 633 Folsom St. in August, the new tenant will use floors eight through 12, as well as the annex of the building…

BOJ Squeeze on Bank Lending Profits Puts Focus on Bond Business

Posted by: | Comments-

First decline in loan balance at large banks in six years

-

Corporate bond issuance at record levels in year to March

A year into the Bank of Japan’s monetary policy experiment in negative rates, the nation’s biggest banks are lending less while large corporations push bond funding to record levels, putting a greater focus on their note underwriting business.

Wall Street Banks Are Beating Main Street Banks at the Start of the Trump Era

Posted by: | Comments-

JPMorgan and Citigroup exceed estimates as Wells Fargo falters

-

‘Competition is back and healthy’ JPMorgan CFO says of trading

U.S. banks reporting their first earnings under Donald Trump’s presidency showed a stark split: Wall Street businesses are faring better than many of those serving Main Street.

JPMorgan Chase & Co. and Citigroup Inc., the two largest U.S. trading firms, posted first-quarter results that beat analysts’ estimates as revenue from buying and selling stocks, bonds and other instruments outpaced expectations. Wells Fargo & Co., which focuses on more traditional forms of banking to consumers and businesses, reported sluggish results and said total loans fell from the fourth quarter…

KPE to Construct New Office Building in Texas

Posted by: | CommentsKP Engineering LP plans to build a new 25,000-square-foot office building in Tyler, Texas, adjacent to the company’s headquarters, which opened in 2015. The new asset will include design workstations and conference rooms incorporating the latest conferencing technology. With construction expected to begin this month, design and engineering of the building are almost completed…

Wells Fargo Says Scandal Costs Will Be Higher Than Projected

Posted by: | Comments-

Expenses could be as high as $80 million a quarter, CFO says

-

CEO says he learned painfully that he doesn’t write headlines

Wells Fargo & Co.’s costs tied to a fake-account scandal are mounting faster than the bank expected as the company incurs expenses for consultants and lawyers.

The lender expects their fees to be $70 million to $80 million per quarter, Chief Financial Officer John Shrewsberry told analysts on a conference call Thursday. That compares with the range of $50 million to $60 million that he gave in February. The CFO said the costs will persist for “several quarters,” even after the bank’s board released a report this week into how the sales abuses started and were allowed to continue for more than a decade…

Skanska to Develop $151M Houston High-Rise

Posted by: | CommentsSkanska will develop and build a new $151 million, 35-story office tower in downtown Houston, which will be anchored by Bank of America.

“We have what we feel is an amazing building,” Matt Damborsky, Skanska Commercial Development’s executive vice president, told Commercial Property Executive. “It has a modern design, interior spaces that encourage collaboration and creativity, and we tried to make the building as efficient as possible to allow tenants the ability to downsize if they needed to do so.”

These Assets Would Benefit From a Weaker Dollar

Posted by: | Comments-

Foreign buyers drawn to U.S. denominated assets amid slump

-

Oil, gold moving in opposite direction from greenback

President Donald Trump likes a weaker dollar, and some corners of the market agree.

Though the greenback’s knee-jerk reaction from Trump’s comments Wednesday has all but been reversed, the U.S. currency appears to be entrenched in a new range amid prospects of delayed policy from Washington and a slower pace of interest-rate hikes. The Bloomberg Dollar Spot Index, slumping 4.5 percent since its January high, headed toward its worst week in nearly a month.

Why You Shouldn’t Judge a Hedge Fund by Its Name

Posted by: | Comments-

Such funds have lower returns and may shutter sooner: report

-

Paper finds gravitas reflects influence, seriousness, power

What’s in a name? For hedge fund investors, sometimes a warning sign.

Hedge funds often choose names with words that reflect authority, stability and power — i.e. words with gravitas. Now a report from researchers at the University at Buffalo and Finland’s University of Oulu finds that investors should beware.

Brooklyn Home Sales Jump Most Since ’10 as Listings Decline

Posted by: | Comments-

Supply of homes at second lowest on record in first quarter

-

‘I’m starving for inventory,’ Corcoran Group broker says

Home sales in Brooklyn jumped the most in seven years while the supply of listings hovered near a record low, pushing buyers toward bidding wars in the New York borough.

Purchases of condos, co-ops and one- to three-family homes jumped 46 percent in the first quarter from a year earlier to 2,800 deals, according to a report Thursday by appraiser Miller Samuel Inc. and brokerage Douglas Elliman Real Estate. The number of homes on the market at the end of March fell 20 percent to 2,290, the second-fewest since the firms started tracking the data in 2008. The lowest period for listings was the previous quarter…

London Housing in Deepest Slump Since the Financial Crisis

Posted by: | Comments-

RICS index for the city drops to lowest level since 2009

-

U.K. housing ‘continues to lack impetus,’ sales stagnant

London’s housing market is in its worst slump since the depths of the financial crisis eight years ago, part of a broader slowdown that may continue.

The Royal Institution of Chartered Surveyors said its price balance for the city fell to the lowest since February 2009 last month. It declined to minus 49, indicating that a greater percentage of agents reported drops in March. Still, more respondents than not still expect prices in London to rise over the next year, the report showed…

TQL Opens Operations Hub in New Orleans

Posted by: | Comments

Third-party logistics provider Total Quality Logistics has announced the opening of its newest 8,125-square-foot facility in New Orleans. The new site will create 97 new jobs over the next 10 years.

The company connects customer freight-shipment requests to a network of independent carriers with available capacity. As a freight brokerage firm, TQL does not handle tangible properties at any point throughout the coordination or shipping process, with 75 percent of the company’s workforce serving as sales brokers. Overall, the firm generated sales exceeding $2.3 billion in 2016…

Kubota Unveils New 193KSF HQ in Texas

Posted by: | Comments

Kubota Tractor Corp. recently unveiled its new headquarters in Grapevine, Texas. The firm relocated from Torrance, Calif., into a two-building campus that includes 125,000 square feet of office space and a 68,000-square-foot research and development facility.

The company broke ground on the new headquarters in 2015, an investment of more than $50 million. CBRE’s Senior Vice Presidents Steve Berger and Ann Huntington, along with Land Broker Marty Neilon, represented Kubota in the search for the building location. The property was built on a wooded site and will use a wastewater treatment system developed by the company, as well as LED lights…

Toronto Home-Price Gains Aren’t Sustainable, Poloz Warns

Posted by: | Comments-

Bank of Canada governor reminds buyers prices can also fall

-

Rate of appreciation is ‘divorced’ from fundamentals

The speculation increasingly driving Toronto home prices is unsustainable, the head of Canada’s central bank said, warning buyers they should be prepared to weather a potential correction.

At a press conference Wednesday in Ottawa, Bank of Canada Governor Stephen Poloz cited recent reports showing prices in the country’s biggest city are rising faster than 30 percent, a pace that’s “divorced” from typical metrics of demand such as income growth and demographics.

Avison Young Inks Office Lease Renewal

Posted by: | Comments

Avison Young’s Atlanta office has arranged a lease renewal and extension at 1775 West Commons Oak, a 79,000-square-foot office building located in Marrietta, a northwest suburb of Atlanta. The building serves as the headquarters of MiMidex Group, a biomedical device firm and a leading integrated developer, processor and marketer of regenerative biomaterial products and bioimplants.

MiMidex Group has occupied the building since 2013, and has signed on for four additional years, committing to the location until 2021.

Paulson Said to Exit AIG Board After Hedge Fund Sells Shares

Posted by: | Comments-

Billionaire joined Icahn in 2015 to push for breakup of AIG

-

Hedge fund has been selling shares as AIG stock trailed rivals

Billionaire John Paulson is planning to step down from American International Group Inc.’s board after his hedge fund sold shares in the insurer, according to a person familiar with the plan.

The move is expected to be announced in the insurer’s proxy filing within days, said the person, who asked not to be identified discussing disclosures that haven’t been made public…

Paulson Said to Exit AIG Board After Hedge Fund Sells Shares

Bank of Canada Decides Trump Isn’t Helping Its Cause

Posted by: | Comments-

rade uncertainty will weigh on Canadian exports, investment

-

U.S. fical stimulus now set to arrive later than forecast

The Bank of Canada has long been searching for growth to rebalance toward exports and business investment to put the economy on a sustainable path.

Now it’s decided U.S. President Donald Trump isn’t helping.

The bank was among the first to attempt to quantify and pencil in the Trump effect on U.S. growth, estimating in January that personal and corporate tax cuts would raise the level of the American economy by 0.5 percent by the end of 2018, while having much smaller positive ripple effects on Canadian activity…

Irvine Co. Inks 50 KSF Leases in Irvine Spectrum

Posted by: | CommentsIrvine Co. has closed six new lease deals for office space in a 426,000-square-foot building part of Irvine Spectrum, a mixed-use community in Irvine, Calif. The new leases total more than 50,000 square feet and bring the building up to 93 percent leased, just one year after opening. The coveted top floor is the only available space left…

Modi’s Record Infrastructure Spending Seen Boosting Loan Volumes

Posted by: | Comments-

Government unveils $60 billion plan for roads, aviation, power

-

Key factor is whether government can spend that much: Deutsche

Prime Minister Narendra Modi’s ambitious plans to spend a record $60 billion on India’s infrastructure this fiscal year may provide a much-needed boost to the rupee loan market after project-finance volumes slumped last year.

Bank loan commitments for project financing may potentially double to 2 trillion rupees ($31 billion) this financial year, according to Muhund Kannappan, a credit trading director at Deutsche Bank AG in Mumbai. Rupee-denominated project finance and capex loans fell 28 percent last year to 1 trillion rupees as infrastructure projects were slow to take off, according to Bloomberg-compiled data…

Plenty More Villains at Wells Fargo

Posted by: | CommentsIn its latest attempt to salvage the reputation of Wells Fargo, the bank’s board announced on Monday that it would revoke $75 million in bonus awards from two former senior executives who it said were largely to blame for a staggering sales scandal at the bank.

Tough as that might seem, it is not enough to punish their misconduct, deter wrongdoing by others and restore trust in the bank — or in the rule of law when it comes to investigating and prosecuting bank executives…

Aspen Skiing, KSL Capital Nab Intrawest Resorts in $1.5B Deal

Posted by: | Comments

The shakeup on the slopes continues this week with the announcement that affiliates of Aspen Skiing Co. LLC and KSL Capital Partners will acquire Intrawest Resort Holdings Inc., a leading North American mountain resort and adventure company, in a deal valued at $1.5 billion.

Fired Banker Sues Credit Suisse After Rogue-Trader Case Collapse

Posted by: | Comments-

Rohit Jha filed unfair dismissal suit in London tribunal

-

Criminal charges against Jha were dismissed last year

A Credit Suisse Group AG trader who was fired after being accused of hiding about $18 million in losses has sued the bank for unfair dismissal after the subsequent criminal case was dropped last year.

Rohit Jha, who handled exchange-traded funds at the Swiss lender, filed the suit in a London tribunal, according to court documents and two people with knowledge of the situation. An April hearing has been delayed until summer, according to one of the people, who didn’t want to be identified because the lawsuit is ongoing…

NYC’s Lipstick Building Lands $272M in Financing

Posted by: | Comments

A joint venture between Ceruzzi Holdings LLC and SMI USA has received $272 million in first mortgage financing for the ground lease position of 885 Third Ave., known to New Yorkers as the Lipstick Building, a 635,000-square-foot, trophy office tower in Midtown Manhattan.

HFF arranged the four-year, fixed-rate loan with Zurich-based Credit Suisse through its U.S. subsidiary, Column Financial Inc.

Investors Are Cherry Picking the Assets of a Fallen Renewable Energy Giant

Posted by: | Comments-

Brookfield agreed to buy SunEdison’s TerraForm yieldcos

-

Projects sold to football club, developers and investors

The spectacular failure of what was once the world’s biggest renewable-energy company has turned into a smorgasbord of wind and solar farms being gobbled up by infrastructure investors, clean-power developers and even a vegan soccer team.

Since filing the largest U.S. bankruptcy of 2016, SunEdison Inc. has hosted the biggest-ever sale of renewables assets. It’s shed at least $1 billion of assets from Southern California to Chile to India — some through record-breaking deals — including projects that would have died without new owners. With wind and solar supplying more than 11 percent of global electricity, the company’s debt-induced collapse enabled competitors to strengthen their existing hands or enter new markets…

John Paulson: Do Not Look At The Man Behind The Hedge Fund

Posted by: | Comments Back in February we noted how strangely fortuitous it was that in the last months of 2016, Paulson & Co. dumped about half of its stock in AIG, where John Paulson happens to have a board seat, at the same time that the insurer was plunging into a gaping $3 billion quarterly loss. This all came to light in February, when on the same day that AIG reported its godawful earnings – and watched its stock drop 9 percent – Paulson’s hedge fund filed its 13F, showing a sale of $300 million in AIG shares in the previous quarter.

Back in February we noted how strangely fortuitous it was that in the last months of 2016, Paulson & Co. dumped about half of its stock in AIG, where John Paulson happens to have a board seat, at the same time that the insurer was plunging into a gaping $3 billion quarterly loss. This all came to light in February, when on the same day that AIG reported its godawful earnings – and watched its stock drop 9 percent – Paulson’s hedge fund filed its 13F, showing a sale of $300 million in AIG shares in the previous quarter.

Bulfinch Office Buildings Receive Wired Certified Gold Designation

Posted by: | CommentsWiredScore, the company behind a system that measures technological capacity in commercial buildings, announced that The Bulfinch Cos. received Wired Certified Gold designations at six of its commercial properties for advanced technological infrastructure.

Bulfinch’s six buildings received the Wired certification based on its multiple fiber providers, multiple points of entry for cabling (with room for growth), easily accessible fiber cabling throughout the entire building, protected and secure dedicated telecom closets to minimize interruptions and a streamlined legal contracting process with carriers.

Australia’s Home-Lending Curbs Could Hit Wrong Target: NAB

Posted by: | Comments-

Demand is momentum-driven as prices keep rising, NAB CEO says

-

Executive performance now measured by customer satisfaction

Australian regulators need to be careful tougher home-lending curbs don’t lock people who can afford to buy a house out of the property market, the chief executive officer of National Australia Bank Ltd. said.

The Australian Prudential Regulation Authority last month tightened restrictions on interest-only loans, which are favored by property investors, as surging home pricesstoke concern of a housing bubble…

Wells Fargo to Claw Back $75 Million From 2 Former Executives

Posted by: | CommentsWells Fargo’s board said on Monday that it would claw back an additional $75 million in compensation from the two executives on whom it pinned most of the blame for the company’s scandal over fraudulent accounts: the bank’s former chief executive, John G. Stumpf, and its former head of community banking, Carrie L. Tolstedt.

The clawbacks — or forced return of pay and stock grants — are the largest in banking history and among the largest in corporate America. A four-person committee of Wells Fargo’s directors investigated the extensive fraud…

Wells Fargo to Claw Back $75 Million From 2 Former Executives

Spirides Arranges $8M Loan for Hilton Hotel

Posted by: | CommentsSpirides Hospitality Finance Co. closed on an $8 million senior loan facility from a southeast U.S. headquartered bank to finance the development of a new Hilton Tru Hotel in Florence, S.C. President Harry Spirides led the debt placement team representing the borrower in this transaction.

The first 18 months during construction will have interest-only mortgage payments priced at the prime interest rate plus .50 percent (currently 4.50 percent) per annum, adjusted quarterly. Upon completion, loan payments will convert to a 25-year fully amortizing principal and interest monthly loan payment schedule. The interest rate of the permanent loan will be fixed for five years, then adjusted every five years. The interest rate will be priced using the 5 year SWAP rate plus 3.55 percent (currently 5.55 percent) per annum. The loan amount was sized using a 75 percent loan to cost ratio, and there is no prepayment penalty after the first five years of the loan…

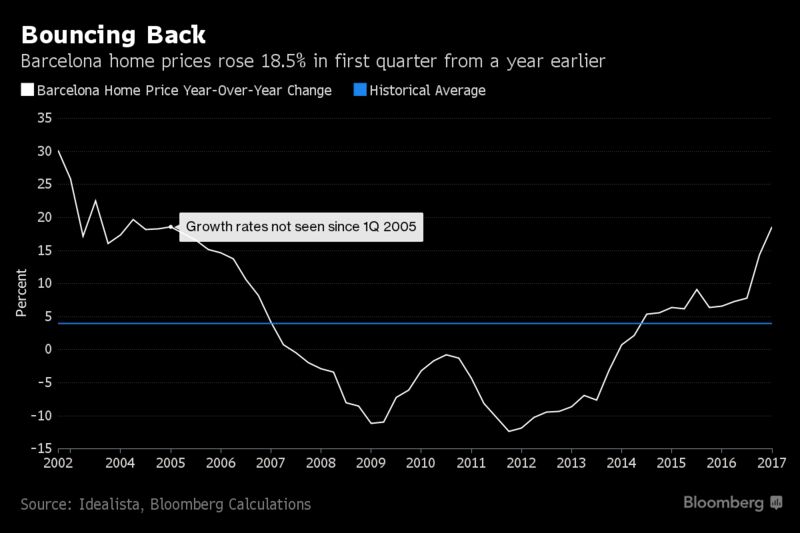

Barcelona Takes Lead in Spanish Home-Price Rebound: Chart

Posted by: | Comments Barcelona led the way in Spain’s property market rebound with home prices accelerating close to 19 percent in the first quarter to about 4,100 euros ($4,350) per square meter, data from Idealista SA, the nation’s biggest property website, showed. Barcelona, the capital of the wealthy region of Catalonia, beats Madrid with the Spanish capital going for about 2,900 euros per square meter…

Barcelona led the way in Spain’s property market rebound with home prices accelerating close to 19 percent in the first quarter to about 4,100 euros ($4,350) per square meter, data from Idealista SA, the nation’s biggest property website, showed. Barcelona, the capital of the wealthy region of Catalonia, beats Madrid with the Spanish capital going for about 2,900 euros per square meter…

Whole Foods Pressured by Activist Investor Jana Partners

Posted by: | Comments The Whole Foods Market at Columbus Circle in Manhattan. Whole Foods faces growing competition as other grocery stores and food companies offer versions of natural and organic products.CreditStephen Speranza for The New York Times

The Whole Foods Market at Columbus Circle in Manhattan. Whole Foods faces growing competition as other grocery stores and food companies offer versions of natural and organic products.CreditStephen Speranza for The New York Times

Whole Foods, the purveyor of organic food products, once shook up the grocery store aisle. Now it is facing pressure for its own shake-up.

Jana Partners, the activist hedge fund founded by Barry Rosenstein, disclosed Monday that it was the second-largest shareholder in the company in a filing with the Securities and Exchange Commission.

Madison Partners Brokers Hollywood Office Sale

Posted by: | Comments

A 29,000-rentable-square-foot office and post-production space in Hollywood traded hands for approximately $12.6 million or $435 per square foot. Madison Partners Bob Safai, Matt Case and Brad Schlaak represented the owner, Ascent Media. A Los Angeles-based private real estate investment company purchased the property in a 1031 exchange.

Located at 6344 Fountain Ave., in the heart of Hollywood’s Sunset & Vine Media District, one of the major office markets in SoCal and home to top entertainment firms, the property is just off Santa Monica Boulevard and State Route 101 with easy access to numerous retail and dining options. The two floors are fully leased to Deluxe Entertainment Services Group Inc…

Hong Kong Plugs Property Tax Loophole Amid Home-Buying Spree

Posted by: | Comments-

New rules intended to prevent multiple purchases of units

-

City’s leaders had imposed new restrictions in November

Hong Kong’s government tightened property rules for the second time since November to shut a loophole that allowed investors to snap up multiple units in one shot to qualify for lower tax rates.

Under the new rules, first-time home buyers acquiring more than one property in a single contract will be charged the same 15 percent stamp duty that applies to purchases of a second property, rather than the 4.25 percent duty for first-time buyers. The change, announced late Tuesday by Hong Kong’s Chief Executive Leung Chun-ying, took effect at midnight…

West Coast’s Tallest Skyscraper Tops Off in San Francisco

Posted by: | CommentsBuilders laid the final beam on Salesforce Tower at 1,077 feet as the $1 billion project developed by Boston Properties Inc. and Hines is nearing completion. Anchor tenant Salesforce plans to move in early 2018.

Salesforce Tower, a $1 billion project reshaping San Francisco’s skyline, is nearing completion. Builders laid the final beam on the 61-story building which is now the tallest skyscraper on the West Coast at 1,077 feet. Salesforce celebrated the milestone last week with San Francisco Mayor Ed Lee, Supervisor Jane Kim, Salesforce Chairman & CEO Marc Benioff, Boston Properties Executive Vice President Bob Pester, Hines Senior Managing Director Paul Paradis and local religious and spiritual leaders from the San Francisco Interfaith Council…

HFF Secures JV Partner for DC Trophy Office

Posted by: | Comments

On behalf of the developer, Lincoln Property Co., HFF has arranged a joint venture for the acquisition and development of 699 14th St. NW, a planned 11-story trophy office building in Washington, D.C., one and a half blocks from the White House. Lincoln’s JV partner is Chicago-based Pearlmark Real Estate, a boutique real estate manager and principal investor.

The Only Solution to Britain’s Housing Crisis May Be a Crash

Posted by: | Comments-

Increasing supply may be of limited help: academic paper

-

Average U.K. house prices are almost eight times incomes

The solution to the U.K.’s housing woes may not be pretty.

Staggeringly high prices, which are preventing many Britons from buying a home, may only be corrected by a market crash, according to economists from the University of Reading. While many say boosting the supply of property for sale would help with affordability, the academics say the effect would be very limited, because the amount of building needed just isn’t feasible…

Ohio State University Announces $1B Energy Management Project

Posted by: | Comments

ENGIE North America and Axium Infrastructure were awarded a $1.16 billion comprehensive energy management contract by Ohio State University. During the 50-year concession, the two companies will work to address the university’s energy sustainability goals for its 485-building campus in Columbus, Ohio.

HKS Expands Footprint with NYC Design Studio

Posted by: | Comments

Dallas-based HKS Hospitality Group, the hotel architecture and interiors division of HKS Architects, recently expanded its footprint with the debut of a hospitality architecture design studio in New York City, its first in the Northeast.

“We now have a home base for all things hospitality in one of the greatest and most profound cities for growth in the world,” Nunzio DeSantis, executive vice president and director with HKS Hospitality Group, said in a prepared statement. With the support of HKS Architects’ six-year-old office in the city, the new design studio will be tasked with furthering HKS Hospitality’s development pursuits across the northeastern U.S…

Gymboree Is Said to Prepare for Bankruptcy as Payment Looms

Posted by: | Comments-

Children’s retailer faces June 1 interest payment on bonds

-

Lenders may take control of company as part of reorganization

Gymboree Corp., the struggling children’s clothing retailer, is preparing to file for bankruptcy as it faces a June 1 interest payment on its debt, according to people with knowledge of the matter.

The Bain Capital-controlled company is seeking to reorganize its debt load and may transfer control to its lenders, including Searchlight Capital, Brigade Capital Management and Oppenheimer Holdings, said the people, who asked not to be identified because the process isn’t public…

Hedge Fund Seeks Spinoff of BHP Billiton’s U.S. Oil Business

Posted by: | Comments Paul E. Singer, founder of the hedge fund Elliott Management, in 2012. CreditSteve Marcus/Reuters

Paul E. Singer, founder of the hedge fund Elliott Management, in 2012. CreditSteve Marcus/Reuters

With an ever-growing war chest — now some $33 billion — the hedge fund Elliott Management has chosen to take on bigger and more complex targets for its brand of shareholder activism.

Now, Elliott has set its sights on reshaping the mining colossus BHP Billiton, proposing steps including a spinoff of the company’s oil operations in the United States.

The push to shake up BHP Billiton, one of Australia’s biggest companies, is yet another ambitious effort by Elliott and its founder, the billionaire Paul E. Singer, to profitably force change at a corporate giant…

Stada to Support Takeover Bid by Bain Capital and Cinven

Posted by: | CommentsLONDON — Stada Arzneimittel of Germany said on Monday that it would support a takeover bid by the private equity firms Bain Capital and Cinven that valued it at more than $4.3 billion, in the latest potential big deal for a maker of generic drugs.

It was one of two takeover offers the company received through a structured bidding process, with Stada’s board concluding the Bain and Cinven offer was “in the best interest of the company and in the interest of the shareholders and other stakeholders.”

Blackstone Grants $100 Refi for Iconic Florida Office Asset

Posted by: | Comments

CBRE recently announced that it has arranged a $100 million refinancing loan for Douglas Entrance, a five-building, Class A office property located in Coral Gables, Fla. The floating rate loan was provided by Blackstone Group and was secured shortly after the completion of a $7 million renovation project.

“Blackstone’s desire to recommit new capital to the sponsor and the property is further evidence of Douglas Entrance’s appeal and stature, serving as the entrance to Coral Gables,” said Amy Julian, vice president at CBRE, in prepared remarks. “Additionally, it demonstrates Miami’s desirability and stability from a financing standpoint.”

Toronto Mayor Says He’s Open to Sale of City Real Estate Assets

Posted by: | Comments-

Tory suggests proceeds could be used for transit projects

-

Recent sale of federal building caught his attention, he says

John Tory, mayor of Toronto.

Photographer: Mark Sommerfeld/Bloomberg

Toronto’s mayor won’t rule out selling some of the city’s prime downtown real estate as he looks to make better use of assets amid an unprecedented property boom.

“Would I take that off the table? No, I wouldn’t,” Mayor John Tory said in an interview last week at Bloomberg’s Toronto office. Selling buildings in the city’s costly downtown market probably wouldn’t be “quite as politically charged” as divesting other types of assets, such as the parking authority or power utility Toronto Hydro, he said…

Hedge Fund Digs Into World’s Biggest Miner BHP: QuickTake Q&A

Posted by: | CommentsSince BHP Billiton was formed at the turn of the century, the world’s biggest mining company has had two legal entities in Sydney and London. Now, billionaire Paul Elliott Singer’s hedge fund, Elliott Management Corp., wants an overhaul of the business, including turning BHP into one company, headquartered in Australia. The proposal, which the company has rejected, risks further clashes between the occasionally activist investor and the $97 billion mining giant.

Webster Bank Closes on $7M Financing Deal

Posted by: | Comments

Webster Bank has arranged a $7.2 million portfolio financing deal for Isle Brewers Guild LLC, a craft beer cooperative located in Pawtucket, R.I., founded by Devin Kelly and Jeremy Duffy. Senior Vice President of Commercial Banking at Webster Anthony Capuano Jr. led the transaction.

Hedge Funders Party With Pearl Jam at Rock & Roll Hall Induction

Posted by: | Comments-

Einhorn, Rosenstein hang in VIP area at Barclays Center

-

Joan Baez discusses injustice, Vedder talks climate change

The dad-rock bands joining the Rock & Roll Hall of Fame this year got the VIPs they deserved: hedge-fund managers who’ve aged right along with them.

David Einhorn of Greenlight Capital, Curtis Schenker of Scoggin Capital and Barry Rosenstein of Jana Partners were seated at tables right in front of the stage to see Pearl Jam, Journey, Yes and Electric Light Orchestra inducted Friday night at the Barclays Center in Brooklyn…

Australia’s Biggest Pension Fund Eyes U.S. Infrastructure

Posted by: | Comments-

AustralianSuper prefers assets such as toll roads, airports

-

Could be four years before money committed, Delaney says

President Donald Trump’s plan to fix America’s crumbling infrastructure with $1 trillion of private and public investment over a decade is drawing interest from 10,000 miles away.

AustralianSuper Pty, Australia’s biggest pension fund with over A$100 billion ($75 billion) in assets, is eyeing the U.S. market for infrastructure debt and equity investment prospects, said Mark Delaney, its Melbourne-based chief investment officer.