About

Skills and Expertise

Commensurate real estate professional with strong experience in real estate principalling and transactional finance. I have 35+ years involved in commercial real estate lending, developments, REITs and syndication deals. I am also an expert marketer with 23+ years experience in Internet and technology automation, including custom lead generation and prospecting management in finance, banking and real estate.

Commercial Real Estate Finance

My clients are folks who are looking for debt and/or equity for acquiring commercial real estate assets or sponsors who are seeking to repurchase their loans and/or recapitalize/restructure their existing assets from ranging from $1 – 30 million.

Structured products I arrange are bridge loans, equity, preferred equity and mezzanine capital.

Specializing in joint venture equity for improved property and land development projects for sponsors and operators who cannot readily access capital from traditional banking sources.

Capital Formation and Introduction for Real Estate Transactions

I have a proven ability to structure simple and complex real estate transactions for real estate sponsors both at the fund level and at the individual asset level across the capital spectrum to minimize dilution and optimize the capital structure. Often these solutions involve a hybrid of debt and equity. Using my distribution capabilities, I am able to target a specific group of investors—either retail or institutional—and organize meetings that can effectively maximize my sponsor’s time.

Bulk Asset Purchases

I also provide liquidity for banks, hard money lenders and other lenders with legacy assets on their balance sheet. This includes a “bad bank” joint venture option. I invest proprietary capital in real estate opportunities within the United States. I and my investment professionals identify, structure and finance the acquisition of real estate assets principally through credit-sensitive residential mortgage assets and other debt interests.

My clients include institutions and sophisticated high net worth investors. I continually evaluate my product line and I am constantly innovating the new and creative.

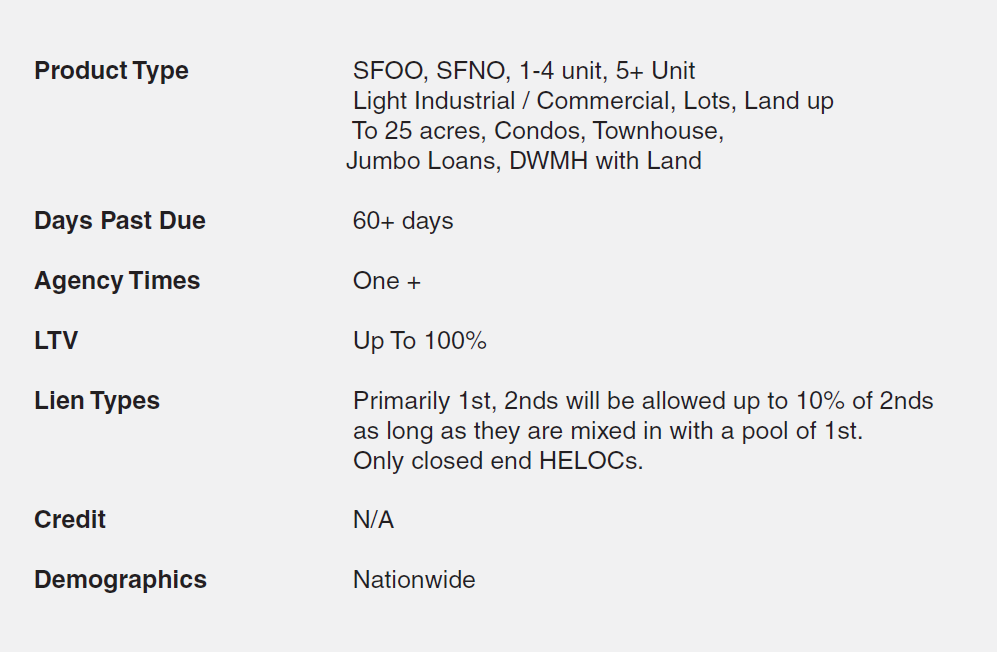

Buying Guidelines for Non-Performing and Sub-Performing

Skills and Expertise

Investment property acquisition, investments, real estate, due diligence, valuation, real estate transactions, real estate finance, commercial mortgages, CMBS, Bulk REO, non-performing loans, re-performing loans, performing loans, capital formation, capital introduction, syndication, investment marketing, real estate capital, real estate investment banking