Aug

13

In High-Yield Energy Debt, Contrarian Sees Value Where Everyone Else Sees Defaults

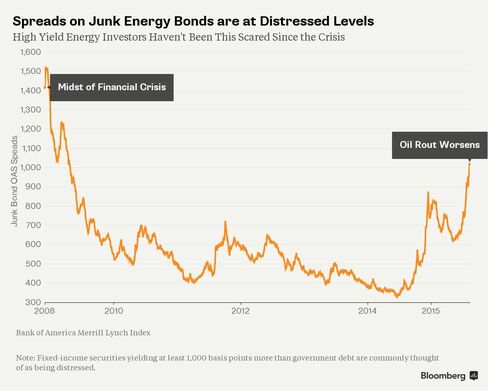

By Spreads on Junk Energy Bonds are at Distressed Levels

Spreads on Junk Energy Bonds are at Distressed Levels

Most junk-bond investors can’t sell their energy-related holdings fast enough. Then there’s Matt Eagan.

The money manager at Loomis Sayles & Co. is going the other way, buying debt in an industry where an alarming number of borrowers increasingly can’t meet their obligations. He’s lured to yields that have surged to the highest since 2009 on the speculative-grade securities of oil and gas companies — in some cases to over 30 percent…

In High-Yield Energy Debt, Contrarian Sees Value Where Everyone Else Sees Defaults